social security tax rate 2021

As of 2021 that amount increased to 65 percent and in 2022 the benefits will be completely exempt for those taxpayers. You would pay taxes on 85 percent of your 18000 in annual benefits or 15300.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Tax rates under the HI program are 145 percent for employees and employers each and 290 percent for self-employed.

. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Exempt amounts under the retirement earnings test 2021 in dollars Age of retired person in 2021. As of 2021 a single rate of 124.

If you have a combined. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level. Topics Center for State Tax Policy State Tax Maps.

Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. Ad See If You Qualify To File For Free With TurboTax Free Edition. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

After 1993 there has been no limitation on HI-taxable earnings. Under FRA 1 for 2 withholding rate 18960. Import Your Tax Forms And File For Your Max Refund Today.

For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad. Workers pay a 62. For married couples filing jointly you will pay taxes on up to 50 of your Social Security income if you have a combined income of 32000 to 44000.

Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the. Social Security taxes in 2022 are 62 percent of gross wages up to 147000. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is.

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. 62 of each employees first 142800. File a federal tax return as an individual and your combined income.

Nobody pays taxes on more than 85 percent of their Social Security benefits no matter their. Social Security functions much like a flat tax. For 2021 the Social Security tax rate for both employees and employers is 62 of employee compensation for a total of 124.

Time To Finish Up Your Taxes. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax.

Different rates apply for these taxes. When you file your tax return. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits.

Fifty percent of a taxpayers benefits may be taxable if they are. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. The Social Security taxable maximum is 142800 in 2021.

The largest increases were in 2020 and 2021 when the limit increased by 36 and. You may then end up with total Social Security taxes withheld that exceed the maximum. Those who are self-employed are liable for the.

The federal government increased the Social Security tax limit in 10 out of the past 11 years. This applies no matter what the other employers may have withheld. Thus the most an individual employee can pay this year is 9114 Most workers.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

How Do Marginal Income Tax Rates Work And What If We Increased Them

Who Pays U S Income Tax And How Much Pew Research Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Social Security Wage Base Increases To 142 800 For 2021

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Government Revenue Taxes Are The Price We Pay For Government

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

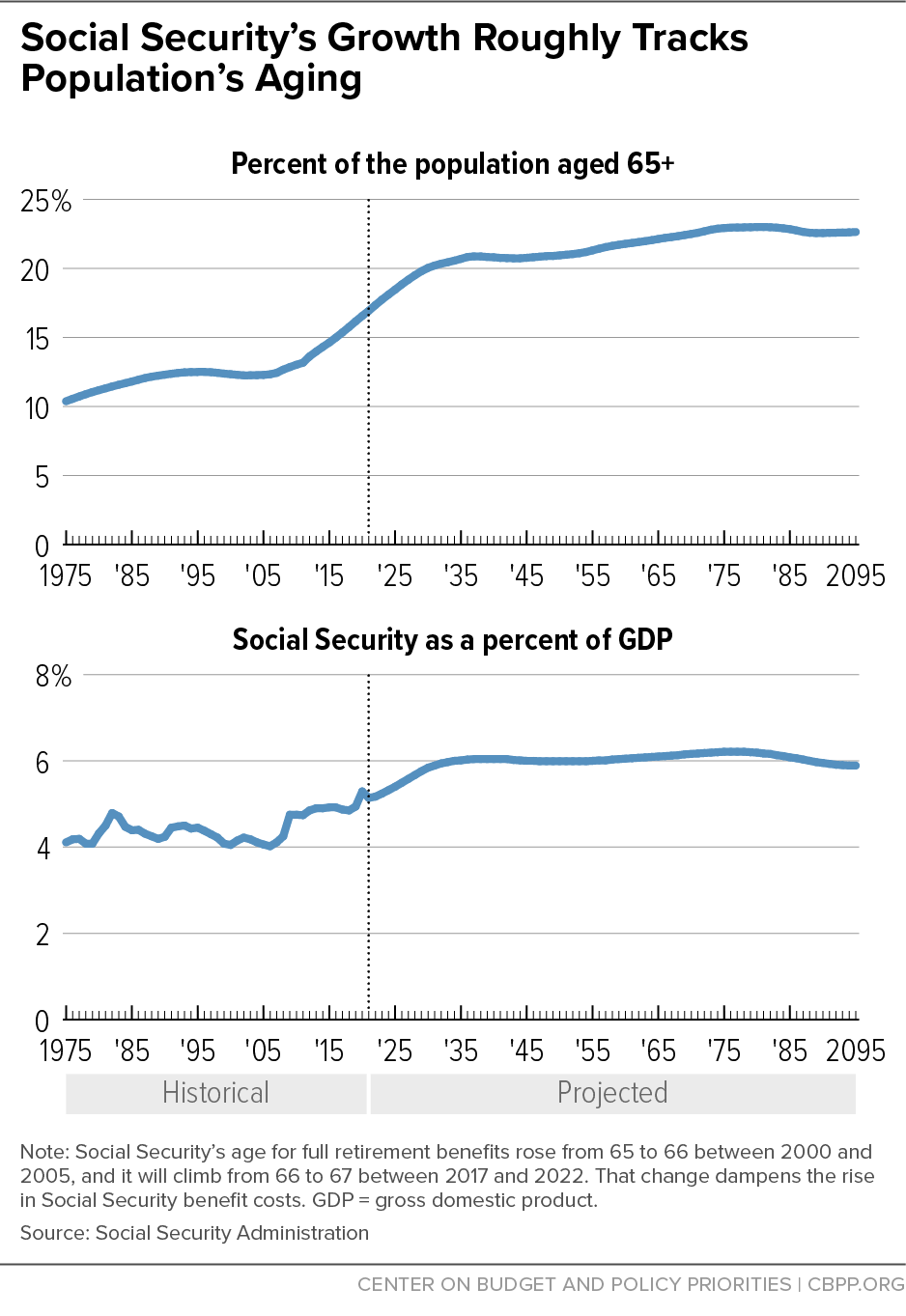

What The 2021 Trustees Report Shows About Social Security Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)